Welcome to my first portfolio overview, it is the starting portfolio for streetsmartcap.

The portfolio consists of nine stocks and one ETF at the moment.

The stocks /ETF are by portfolio size:

Republic services Group (RSG) 16,62%

Northeastern Bank (NBN) 16,27 %

Fairfax Financial Holdings (FFH.TO) 15,87%

Protector Forsikring (PROT.OL) 14,44%

An ETF Vanguard S&P500 distributing 14,24%

Kinsale Capital (KNSL) 11,67%

Moodys (MCO) 5,02%

Uber (UBER) 3,93%

Chapters Group (CHG.DE) 1,83%

Meta (META) 1,12%

Yeah, I know, if added the numbers are not correctly 100%, but that is due to rounding.

For visualization a pie chart.

The Portfolio is in EUROS, for better comparability I will write both, the US-Dollar prices and EUROS of the stocks. Todays date is used for the exchange rate.

The price of the stocks, at buying time:

Fairfax Financial for 1433€/ 1695,10$

UBER for 70,72€/ 83,65$

Kinsale Capital 344,60 €/407,63$

North Eastern Bank 86 €/ 101,73$

Republic Services Group 180,29 € /213,27$

Protector Forsikring 39,90€/ 47,20$

Chapters Group 38,90€ / 46,01$

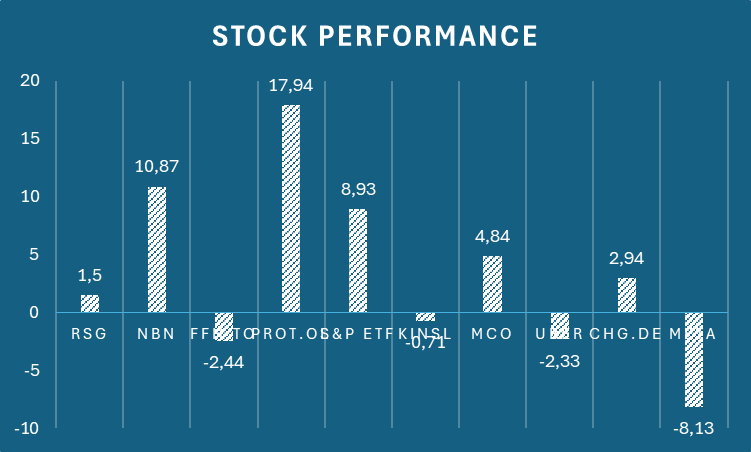

How much did the stocks perform, since i bought them?

I started the portfolio freshly, most of the stocks are bought in the last 2 months. Here is a chart which displays how much each stock declined or elevated in price.

My META position is a gift from my broker, for recommending a friend. That is the reason it is so small. I got it for free, but because I had to pay order provision my broker has booked it with a minus.

The next update on my portfolio will include a comparision with the S&P500 YTD.

Hope you read it too!

Disclaimer: The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences, and the way I transact.